By Steve Garske*

The rush is on for the copper, silver, nickel, and other hard-rock minerals of the Lake Superior region, and especially Michigan's Upper Peninsula. One of the latest arrivals to the UP is the recently formed Highland Copper Company, Inc. This month geologist and Highland Vice President for Exploration Dr. Ross Grunwald has been on tour, giving a detailed powerpoint presentation of the company's activities and plans in Ontonagon, Ironwood, Calumet and Houghton.

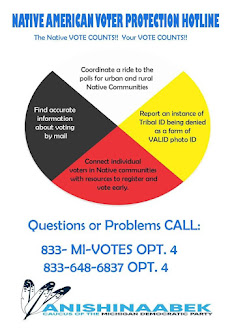

Ross Grunwald points out Keweenaw ore deposits during Highland Copper's presentation at their Jan. 15, 2014, community information meeting in Calumet. (Photo by Keweenaw Now)

Highland Copper Company Inc. is a Canadian company based in Longueuil, Quebec. Along with its wholly-owned subsidiary Keweenaw Copper Company, the company is "focused on exploring and developing copper projects within the Upper Peninsula of Michigan, U.S.A." Incorporated about two and a half years ago, they now have 21 full-time employees. They are currently exploring four deposits -- three in the Keweenaw Peninsula and another near Bald Mountain, north of Ironwood near Lake Superior. They are also in the process of buying the White Pine facility and mineral rights from Copper Range Co., a subsidiary of First Quantum Minerals LLC of Canada. Drilling is being done at all these sites. As noted in a Jan. 10, 2014, Daily Globe story, the drilling at Bald Mountain was not generally known until Grunwald mentioned it at the Ironwood meeting.

Grunwald explained that at this point at least, the Highland (and Keweenaw) Copper Companies are mining exploration and development companies, not mining companies. If the prospects turn out to be economically viable, they would probably be sold to other companies that would mine them. The company provided a fact sheet with a map of their projects. Their extensive website has quite a bit of information about the company, including the results of drilling done so far.

Grunwald and his partners are not the only ones that believe there's money to be made from these prospects. Highland has been wildly successful in raising investor funds, bringing in some $25 million since Sept. 30th in a stock offering of 43 cents per share. The money will go to continued exploration, as well as the purchase of the White Pine mine. Grunwald stated that if and when White Pine is reopened, a new underground mine would be constructed to access the extensive copper deposits northeast of the present mine. The tailings could be backfilled into the old, water-filled mine. While smelting would not be done at White Pine, some concentrating of copper ore could be done there using staged flotation reactor technology. Meanwhile the company's stated intent is to continue to explore for copper and other minerals throughout the Keweenaw region.

In their online "Corporate Presentation," the company notes that Michigan has a favorable political climate for mining. Their list of "favorables" includes support from the Governor and local officials, new laws encouraging mining and making Michigan a "right to work" state, and a "supportive" Michigan Department of Environment Quality staff. They state that local citizens favor development but admit that some "have questions."

When asked at the Ironwood presentation whether Highland Copper Company had any financial ties to billionaire Chris Cline of Florida, Cline's GTac corporation, or the Houston-based Natural Resource Partners (NRP), in which Cline is a major investor, Grunwald gave a flat-out "No." A bit of online research reveals a much more complicated picture, though.

As mentioned in several places on their website, Highland has entered into a joint venture partnership with an entity called Bowie Resource Partners LLC (BRP LLC). BRP LLC is a joint venture formed in June 2010 between Natural Resource Partners L.P. (NRP) and International Paper (IP). Both companies are listed on the New York Stock Exchange. According to their website, BRP owned approximately 8.8 million mineral acres in 29 states, including approximately 60,000 gross acres of copper rights in the Upper Peninsula of Michigan as of 2011. Once mainly invested in coal, BRP's holdings now include everything from oil, gas, and mineral rights to water rights and cell tower placement rights.

According to page 71 of NRP's 2012 Annual Report, Chris Cline owns 31 percent of NRP. As outlined on NRP's website and their prospectus, NRP is the managing and controlling partner of BRP with a 51 percent interest, with IP controlling the remaining 49 percent. Furthermore, oilman Russell Gordy of Houston, owner of RGGS Land and Minerals LLC, sits on the NRP board of directors. RGGS owns most of the surface and mineral rights leased/optioned to GTAC in Iron County. BRP owns and manages current mineral leases, and manages the development of the more than seven million acres of former International Paper land.

Thus Highland has a joint partnership with BRP, which is controlled by NRP, of which Chris Cline (owner of GTac) is a major shareholder.

There can be little doubt that the descent of multiple mining companies on the UP and states west is a well-planned, well-funded effort by incredibly wealthy investors to turn the Lake Superior region into a major industrial and resource extraction zone, similar to the Appalachians of West Virginia (where Cline got his start in the coal industry). The question is whether the citizens of the region will let them.

(For more on the financial connections between Cline, GTac and NRP, check out the interesting and well researched article "Circles of Friends -- Spheres of Influence," by Woodsperson, posted Dec. 10, 2013.)

*Editor's Note: Guest author Steve Garske is a resident of the Western Upper Peninsula. He attended Highland Copper's Jan. 9, 2014, community information meeting in Ironwood. Watch for our coverage of Highland's Calumet (Jan. 15) and Houghton (Jan. 16) meetings -- coming soon.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment